When I found out how low people’s mortgages were with 1-2% interest rates, I was determined to figure out how buying works. When you break it down, it’s not that hard…

1. Find a place you want to buy.

2. Deposit = 20% of the sale price

20% is the magic number here. The Swiss are rather reserved, hence the large number. I have heard cases of people negotiating the bank down to 15% or even 10%, but with the economic situation turning a little in the last year, many banks are sticking to the 20% rule and the fact is, if you cannot afford to give them the 20% (even if you negotiate down to 10%) then they will not loan to you.

3. Calculate the affordability

The same way that Swiss calculate if you can afford your rent by making sure it is 1/3 or less of your monthly salary, they make sure that you can afford buying a home too.

Interest rates might be historically low right now, but every bank uses a simple method to figure out if you earn enough money to live comfortably with a mortgage. Affordability rates are based on 5% interest regardless of the current prices. If you cannot afford to pay a 20% deposit and 5% interest mortgage, the bank will not back you.

Obviously if interest is at 8-10% you would also need to be able to afford that for the bank to lend you money, but since rates are close to zero right now, every bank is calculating based on the average 5%.

To figure out your monthly costs you can plug everything into a simple Excel sheet and run the numbers to see if buying makes sense for you. Along with monthly interest payments, you need to amortize your mortgage by 1% monthly. The typical Nebenkosten (utilities) you normally pay along with your rent are estimated around 0.7% of your property’s value along with a renewal fund of 0.3%. Flat owners pay into a communal renewal fund to fix things like roofs and home owners save to pay everything themselves.

So, that’s another 1% on top of your mortgage and 1% from the sale price. The total monthly payment still needs to be under 1/3 of your monthly income in the 5% model for a bank to consider this a safe purchase.

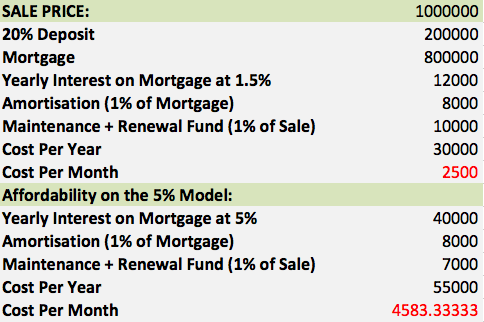

Here is a quick affordability model on a 1 million CHF house:

If one has the 200k capital for the downpayment, buying 1 million CHF houses is not actually the most crazy thing in the world right now. It would, however, require an annual household income of approximately 180,000 CHF. (4583.33 CHF X 13 months salary = 178,749 CHF)

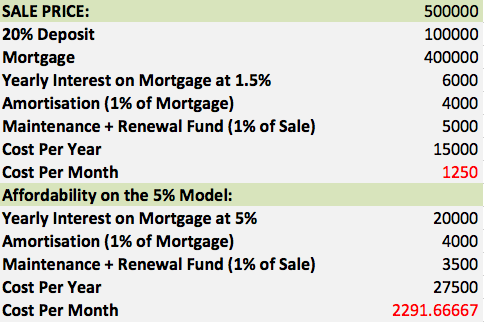

But when I was researching house buying, I learned another important lesson: Not every house or flat in Switzerland costs millions! There are actually a handful of flats available for 300-500k CHF as well as many more in the 500-800k range. What does the affordability look like for a 500,000 CHF flat?

Once you have the 100k downpayment, buyers would only have to an annual household income of 90,000CHF to afford a home with this price. And 1250CHF a month on the current model is less than half of what we currently pay for rent. Numbers like these are what turned me on to looking!

The affordability model can also be used in reverse. To find out how expensive of a home you can afford, just multiply your savings by 5 to see which houses you can afford. With 80k you can probably afford a 400k house. With 150k you could afford a 750k house.

4. Make an offer

The fun part of making an offer, countering, and most likely raising how much money you wanted to spend. The real estate market is pretty tight here and most sellers enjoy a couple rounds of offers from bidders fighting to buy a house.

You can be sure that if you buy a preexisting house in a nice location, there will be many people looking to buy it. Some people spend years looking for a house to buy and it’s very likely that your house buying experience will be filled with a lot of heartbreak, unless you are able to shell out a lot of money.

5. Finding a mortgage

Often people will visit some banks before they start looking to buy homes to know that there are already financial institutions who will support a purchase.

After you find a place and agree on a price (Hah! Easier said than done!) it is time to find the best mortgage. This is where you can shop around for the best deal, with lenders bending over backwards to make you their client.

6. Closing and handover

When you get through all the complicated shit of agreeing on a sales contract, having a lawyer or insurance agency proof the contract and recommend changes, house inspections, and a bunch of paperwork about the house and land dating back hundreds of years, you will need to get everything notarized to make the sales contract official and agree on a payment schedule and handover process.

Notary costs usually range around 1.5-2% of the sale price, but depending on what kind of house you buy you might also have to pay for land register and permit applications, which could take the number up to 2-5% of the sale price.

Payment schedules vary depending whether you are buying a new or old house. Older houses might require a small downpayment and then the remaining amount paid when your permit is approved. For people building, there is usually a large downpayment, halfway progress payment and then the final 1/3 or so is due when the keys are handed over.

Once you understand how much you can afford, the whole process is relatively straight forward. Be prepared to spend a lot of time visiting homes and building sites and even more prepared for all the paperwork that will come your way if you decide to purchase.

How does the buying process vary where you are from?

Want to catch up?