I mentioned how 70% of the population in Switzerland rents, but did you know that it is estimated that only .06% of the flats in Zürich are vacant? That’s not a typo. 99.94% of the flats here are taken.

TMLSS: It’s hard to secure a flat, especially for a good price.

This is a short (long?) guide about how to rent here based on our experience.

Step 1: Prepare your application documents (BEFORE looking for a flat)

A. Go to the local registry office and request a “Betreibungsauszug” if you have been in the country 6 months or longer. This is basically a piece of paper that says you don’t owe anyone any debts and without it, you are often very unlikely to get a flat. For newcomers who do not yet have a debt free history within the country, this can be especially crippling because without this paper… you may appear untrustworthy to a landlord.

B. Have a copy of your residence permit/work permit and passport or your ID if you are Swiss. Please note, residents with temporary permits (L) are also very unlikely to be accepted for a flat, but for some people this is their only option.

C. Copies of the last 3 months pay slips from work or a letter from HR stating your salary. In general, you are not allowed to rent a flat that is more than 33% of your salary.

D. If you have a letter from your HR or previous landlord, make sure you have copies ready. Also prepare contact details (phone numbers) for any references you wish to include on your application.

E. Start preparing a cover letter for your applications which you can modify for different flats. Write about yourself, why you want the flat and why you will be an excellent tenant choice.

F. It is not required, but I recommend including a photo of yourself as well.

Step 2: Look for a flat

Make a budget around 1/4 to 1/3 of your monthly salary, but not more. Landlords often will not rent to you if you earn “too much” or “too little”. Start looking for flats on sites like www.homegate.ch, www.comparis.ch, www.immostreet.ch and the local newspaper. Tell everyone you know that you are looking for a flat and ask if they know anyone that knows anyone that knows anyone. Friend connections are still the best way to get the early scoop on a cheap flat up for grabs, but most of us have to do the legwork on sites like homegate and hope it works out.

Step 3: Visit

Almost no landlords here rent flats without meeting tenants first or knowing they have viewed the apartment in person. Either make an appointment with the current tenant, landlord, or show up for pre-scheduled flat viewings listed online.

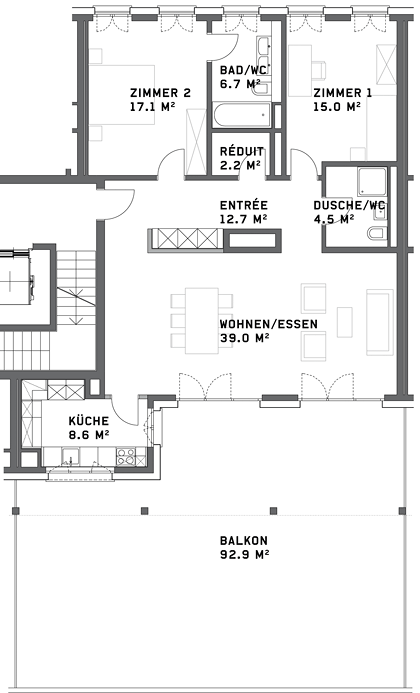

During the visit it is important to ask all your questions about the flat. Here are some of our favourites:

- Why are you moving out?

- Is it a quiet neighborhood?

- What are the neighbors like?

- Is this a smoking building? Do you smoke?

- Is there a cellar in the basement and may I see it? (Cellars or attics are pretty standard with flats in Switzerland)

- What are the utilities like?

Step 4: Apply IMMEDIATELY

Now this step is crucial, so pay attention.

If you show up to a flat viewing, there may be 200 other people there. That’s truly happened to me before. 200. People.

It is important to show up to viewings exactly when they start and to post your application or turn it in immediately. This is why it is so important to prepare your paperwork ahead of time. If you like the flat and they have applications available there, fill it out and turn everything in together as soon as possible. Same day if possible. Your renting livelihood depends on it.

Renting applications generally ask for all applicants’ citizenship, age, gender, personal address, work address, phone number, reference numbers, how much you earn, if you have children or not, if you have pets, and even if you play an instrument.

If you hide the fact that you have a dog and you play the piano, the landlord will not be very happy later on and they may ask you to move out because you are violating their terms of agreement. Also, be prepared to have all your references checked up on. They are very keen to have a nice tenant with such a large pool to choose from.

Step 5: Wait for news

Most landlords have already made up in their mind what kind of tenant they want. They may be looking for a single male, single female, a couple without children, or a family, but you can be sure they will not tell you what kind of person they are looking for. That would be too easy!

Applying before anyone else gives you a small leg up because they often give flats on a first-come-first-serve basis if you meet their qualifications.

Points may be taken off if you are an unmarried couple because the landlord is wary about a possible breakup, families with small (noisy) children, roommate situations because again the landlord is wary of people moving out, and anyone with a pet or loud musical instrument is going to have difficulty finding a landlord that accepts them.

Step 6: Rejection

Kay looked for flats for six months after he finished university before he found one he liked that agreed to rent to him. When we moved in together, we searched together for 7 months before finding a flat that would accept us.

We went through a lot of rejections. We weren’t sure if people were unhappy that we weren’t married or didn’t have kids or that we earned too much or too little. There’s never any feedback on why you are not accepted.

Repeat Steps 1-5 until you can make it past Step 6.

Step 7: Acceptance

Hallelujah! You thought this day would never come.

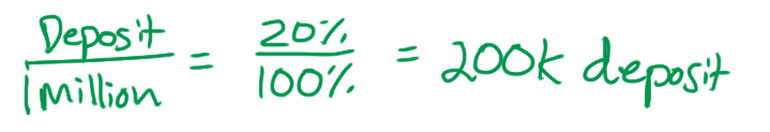

Usually when a landlord agrees to rent, you will meet with them or their agency to sign a contract after you agree on a move in date and give your deposit into a 3rd party bank account that neither of you have access to.

Deposits are usually 1-3X your monthly rent. If you are renting a modest 2500CHF one bedroom flat in Seefeld, your deposit just might be 7500CHF. (That’s over $8000 USD at this time.)

Rent is also due upfront, not at the end of the month… so when you move in you will usually be required to give either 3 or 4X your monthly rent unless you can negotiate a 1 month deposit. For a 2500CHF flat, this would be a whopping 10,000CHF!

But don’t worry… employers are often friendly and will loan you money to pay for your deposit if you are just moving here for the first time. And fret not, even people with dogs and pianos or unemployed fellows can find a flat. You just need to persevere. 🙂

I’ll get into taking over and leaving a flat in another post. 😉

How complicated is the rental process in your area?

*All photos are personal unless noted*

Want to catch up?