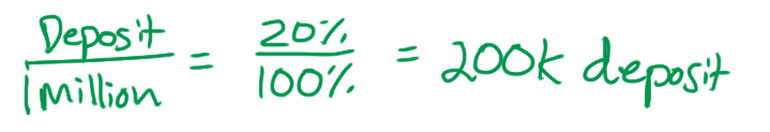

For the first five years in Switzerland, I assumed that I would never, ever be able to afford a home here. I mean, when I first started I was earning 200CHF a week as an au pair. There was no way in hell I’d ever have enough for a 200,000CHF deposit.

After I changed jobs, Kay and I would still chat about it from time to time. His parents own a house and I was vaguely interested in how the buying process works here, but I didn’t understand it. Kay explained that the aim was not to own 100% of your house and that you would always owe the bank money.

That just didn’t make sense.

I put my house-buying dream up on a shelf for a long time and forgot about it. Years rolled by, we got married last year, and somewhere around November/December, two things became important:

- After three-four years of saving from our big boy and big girl jobs, we were actually starting to have a sizable chunk of money.

- Everybody was talking about the crazy low interests rates in Switzerland.

When I say “crazy low” interest, I mean it. Interest rates effectively dropped to 0% for Libor mortgages in September/October 2012. That doesn’t include the bank’s cut, but it was enough to pique my interest.

Fixed mortgage rates were hovering around 1.5% and I learned that my FIL’s mortgage payments were about 1/10th of our monthly rent. With that knowledge, I had to at least figure out how it all works!

Homeowners, what got you interested in buying?

Want to catch up?