Lauren posed this question on my previous entry and it got me thinking: Why is Switzerland so expensive? Especially compared to all the European countries surrounding it?

After living here for a few years, I do have several suspicions why.

(Photo via socialjusticefirst)

(Photo via socialjusticefirst)

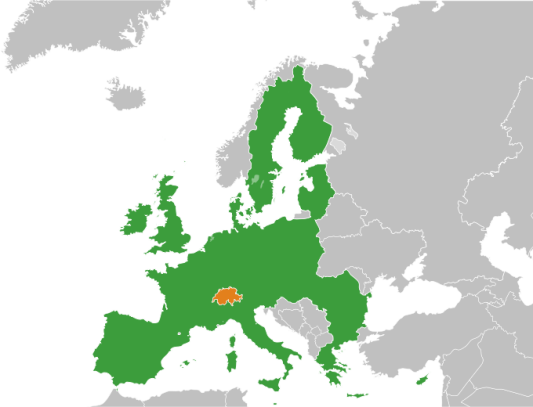

First is that Switzerland IS an island of sorts… we are located in the middle of the EU, but not part of it. This makes a huge difference with import and export and VAT going between the different countries, especially if goods are made in one country, filled and assembled in another and then delivered and sold in another country.

The EU-island position also affects supply and demand on a local level as well. Many places online will ship everywhere in the EU but not to Switzerland. Try buying something on Ebay.de and asking them to ship it to Switzerland. No bueno. It’s why we had to ship our Tempur mattress to a town just over the border in Germany and then pick it up ourselves and pay customs tax going back into Switzerland.

The second reason this place is expensive is that minimum wage is much higher in Switzerland. Labor and services all cost more, so the actual prices of the products need to be able to sustain the salaries of the employees. Grocery store clerks earn around $25/hr for example. I’m pretty sure if all the cashiers at Krogers earned $25 an hour, the milk in Columbus would have to cost a little more. 😉

(Image via Blick.ch and an article about the plight of cashiers only earning 3700CHF – $3963 a month)

(Image via Blick.ch and an article about the plight of cashiers only earning 3700CHF – $3963 a month)

Restaurant prices seem exceedingly expensive here when a quick lunch can easily run you 20-30CHF and a proper dinner is minimum 50-100CHF. But if you think about how much it costs to import high quality food (Swiss are a bit picky about where food comes from and they have regulations), how much the rent of the restaurant costs ($$$) and that the waitress and cooks are all earning at least 30-35/CHF an hour, it’s not really a surprise. Still, that doesn’t stop Kay complaining in wonder how they can charge 50CHF for a steak entree.

Naturally with such a small country, even if the population is not very dense in some areas, the real estate is still ridiculous. Think San Fransisco. Rent is expensive and with many regulations on how and where you can build, there won’t be tons of sky scrapers popping up in Switzerland to alleviate the housing issue any time soon. That’s why areas like Zürich only have 0.06% free apartments and landlords can charge 4000CHF a month for a run down old flat.

Now in addition to the supply and demand restraints from the EU and the higher salaries people enjoy here, there is something even bigger that affects the cost of goods and services: Low taxes.

Let’s be honest, compared to many EU countries (Germany, Netherlands… I’m looking at you!) we do have pretty low taxes in Switzerland. The fact that they are so low is one of the reasons why taxes are such a big problem for Americans here. We are supposed to pay the difference to Uncle Sam what we’d pay in the States. The problem with that is that Uncle Sam doesn’t know that part of why the taxes are so low here are so that Swiss can use their own money to pay for health care, ridiculous rent, unbelievable grocery bills, more expensive restaurants, crazy priced clothing and everything else.

Basically, you could say that goods in Germany are much cheaper because overall German salaries are much lower and their taxes are much higher. They cannot afford to pay more. In Switzerland with low taxes and higher salaries, we make up the difference by paying out of pocket. In essence, they charge more because they can. But if you travel here, out of context everything looks absurdly expensive!

It’s interesting that IWC is able to price their watches much higher in Switzerland because the demand for them here is much higher than in the USA. They know that the Swiss population has money so they price accordingly.

After five years here, I still seem to have sticker shock when I think how much things cost in the US. I actually believe now that goods in the US have to be subsidized for the Americans or many families wouldn’t be able to afford everything they need. That’s why sometimes we see Swiss-produced fondue selling for less in America after export and Ikea products sometimes 1/2 what you would pay in Switzerland. It drives me nuts, but that’s the way it is.

This is why most German towns over the border are filled with Swiss cars doing their weekly shopping, but for many it is simply too much hassle to go to Germany every time you want to re-stock your pantry. And with the limits on how much meat, eggs, milk and so forth that you are allowed to bring in, it’s not worth it for us to go so we shop locally and I just ignore most of the prices on the receipt. 😉

What do you guys think about the pricing in America? Have you ever wondered why some things are so affordable? We Americans complain a lot about gas prices for instance, but they are so much lower than everywhere in Europe. What’s your take on that?