By the time March rolled around, we decided it was time to figure out our mortgage once and for all. Our list of places that work with Americans despite FATCA requirements had grown smaller compared to last year, so we only had 4 banks to choose from compared to the 30+ that most Swiss have available to them.

Still, Kay went to all of them (ZKB, UBS, CS and a local bank Linth) and told them we wanted to see some offers for either 100% Libor mortgages or 100% 5 year fixed mortgages.

Unlike the US, 20-30 year mortgages don’t really exist here. The highest model offered to people is usually a 10 year fixed mortgage. As I’ve said before, the point of your mortgage is not to pay the whole house back by then. After 10 years, you simply have to refinance your mortgage for another 1-10 years, depending on your plans. If you would secure a 10 year mortgage, it is usually not in your interest to try to “sell off” the mortgage with the house. Unless interest rates have skyrocketed, a 10 year fixed rate is usually more than what buyers would be able to find on their own for the same amount of time left on your mortgage. Buying a place with a 30 year mortgage and then selling it off? Forget about it. It doesn’t work like that here.

Since we are coming to a crossroads in about five years, we do not want to be tied to the flat longer than that. Five year fixed rates are also MUCH cheaper than 10 year fixed rates, so that’s a bonus too.

Kay went back and forth between the banks and let the bankers battle it out… we were just interested in getting the best rate possible, which we made clear from the start! It came down to a very exciting hour as Kay was calling me telling me he’d had both guys on the phone and needed to call one of them back and make a decision…. soooo, we went with the small bank!

Bank Linth bent over backwards to meet our goals and they were very excited that we promised to move all our money over to them. I am a little sad to leave English online-banking and paperwork (ugh, German paperwork… ugh!) but it will be good for me. (Hopefully.) And the advisor at Bank Linth was really the nicest out of all the people we met with.

UBS? I was really disappointed. We have almost all our money with them now and then sent this stodgy old man to talk to us. He didn’t even try offering us a first-time buyers mortgage like ZKB did. And when he heard we had better offers than him, he just said “Oh, that’s too low! We can’t do anything about it.” Not really a salesman in my eyes. I’d much rather work with a small bank and receive the care and attention we deserve. (Ok, I think we deserve it…!)

Homebuyers, did you go for a big bank or somewhere local? How did you make the choice?

Want to catch up?

- Nobody buys a home in Switzerland

- How to rent a flat in Switzerland

- Dreaming the impossible

- How to buy a house in Switzerland

- Shopping for houses

- The World of Neubau

- Flat A vs Flat B: Location vs. Cost

- Paying for Sunshine

- We (I) make a decision

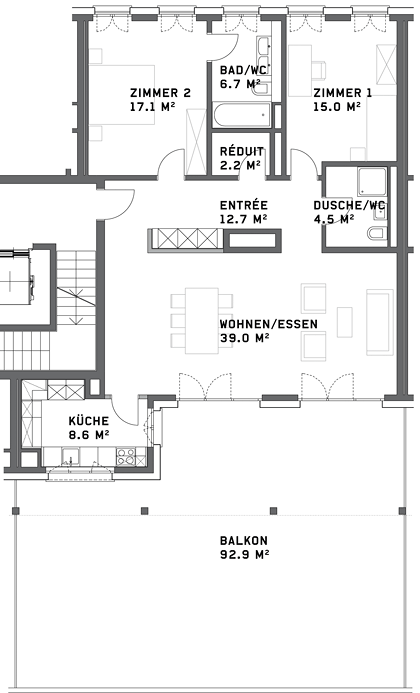

- Our future home: Part I

- How we found our giant terrace

- No Mortgages for Americans? Signing the Contract

- Neubau Progress: I

- Neubau Progress: II

- Neubau Progress: Shower vs. Bathtub

- Neubau Progress: Changing the Electric

- Neubau Progress: Bathroom